Kodak announced today that it has sold its Image Sensor Solution division (ISS) to Platinum Equity for an undisclosed amount. Hopefully, under Platinum's new ownership, ISS will continue to produce its excellent sensors, which are used in both the Leica M9 and the Leica S2.

Press release:

ROCHESTER, N.Y., November 07 – Eastman Kodak Company (NYSE:EK) announced today that it has completed the sale of its Image Sensor Solutions (ISS) business to Platinum Equity in a move that will sharpen Kodak’s operational focus and strengthen its financial position.

While the financial details were not disclosed, Kodak will have continuing access to the image sensor technology involved in this transaction for use in its own products. Kodak has previously communicated that it would sell assets that are not central to its transformation to a profitable, sustainable digital company. This sale is aligned with that strategy to generate cash to complete the transformation.

Included in the sale is a 263,000 square foot facility in Eastman Business Park in Rochester, N.Y., that houses manufacturing and research facilities.

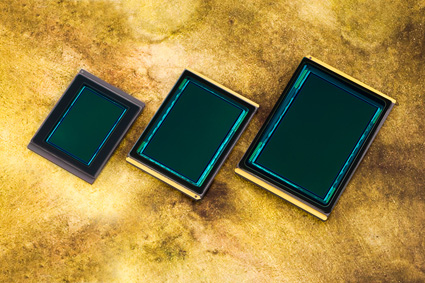

The ISS business develops, manufactures, and markets the world’s highest performance solid state image sensor devices. Over the past 30 years, Kodak’s image sensors have delivered unrivaled image quality and innovative features for use in a broad range of demanding imaging applications. From precision manufacturing inspection to digital radiography, from earth imaging satellites to traffic monitoring, from the world’s highest performing studio photography cameras to DNA sequencing systems, customers around the world rely on high-performance products from ISS in the most mission-critical applications.

Platinum Equity is a global M&A&O® firm specializing in the merger, acquisition and operation of companies that provide services and solutions to customers in a broad range of business markets.

“Image Sensor Solutions is a business that is well-positioned in the high-performance imaging markets in which it participates,” said Pradeep Jotwani, President, Consumer Digital Imaging Group, and Senior Vice President, Eastman Kodak Company. “This sale maximizes shareholder value by obtaining a full and fair valuation for this business, and allows Kodak to increase its financial flexibility.”

Jotwani noted that Platinum Equity brings significant financial and operational resources to the ISS business and a comprehensive plan to ensure its continued success.

“Platinum Equity is an ideal acquirer of Kodak’s ISS business because they are committed to the success of the business for the benefit of customers and employees,” Jotwani said. “I’m very pleased that we have such a favorable outcome for all of our constituents.”

Platinum Equity focuses on acquiring businesses that can benefit from the firm’s extensive in-house capability and expertise in transition, integration and operations.

“This is a great opportunity to acquire a business with an impressive record for delivering innovative solutions to customers around the world,” said Brian Wall, the partner at Platinum Equity who led the team pursuing the acquisition. “The ISS business has a strong management team with the right vision for leading the company into the future. We share their commitment to product development and customer service and are committed to helping the business realize its full potential.”

Wall said Platinum Equity’s experience managing complex transitions from corporate parent companies will benefit employees, customers and other partners.

“Our operations group will work hand-in-hand with the management team to ensure a seamless transition while allowing the organization to stay focused on delivering world class imaging products and solutions,” said Wall. “We are proud to have forged a unique divestiture solution in partnership with Kodak that serves the best interests of everyone involved.”

Quite an interesting deal and promising. Even if it looks like we are loosing the Kodak Brand for the Leica Sensors.

http://www.democratandchronicle.com/article/20111108/BUSINESS/111080311

Admittedly, I am not a business insider, but it sounds like a disaster for Kodak to me. They are banking on being a leader in the digital field, and they sell their sensor division, all their sensor R&D and their patents? And a company called Platinum Equity does not strike me as being geared towards holding a company long term and letting it grow. My suspicion is that they will rip it apart for maximum profit, and resell it to another imaging company. So contrary to the idea that it will “benefit employees, customers and partners”, I would suspect that it is to the great detriment of the employees, customers, the Kodak brand and to the enormous benefit of the partners at Platinum Equity and at whatever investment firm helped broker the deal. Maybe I am just a pessimist.

I don’t think your are being too pessimistic Stuart, but I hope against hope you are wrong. I have confidence Leica has been getting itself in a better position knowing that Kodak has been ailing for a while now. Frankly I am surprised that Kodak would sell off the sensor division since it is the one thing that differentiated Kodak from most of the other digital imaging companies (very few design and make their own sensors). The need to raise money can make you do some crazy things.

The disaster for Kodak was that it was run by people which led the company to the point where we are now. Taking this as the foundation, it is good to know that the good parts of the company, even if not being under one roof/brand anymore, have a chance to survive and maybe with money available for investments for even more. It is good to know that the Kodak Sensor division is worth an investment. I do not believe in “ripping apart” because they only bought a part. I do think when taking a look at the imaging sensor market, that there is a good growth potential, means it is worth an investment. That is what I meant by promising. And I do not have a problem when whoever is investing in something, making it more profitable, more interesting and then selling it for a higher price. If it is just a business, I would do the same.

And of course it is very sad seeing a company like Kodak with such a long history falling apart.

I agree with you in principal Pete, but I unfortunately I don’t think it will go down that way. My pessimism may be colored by the fact that I have experience (albeit secondhand) in how investment firms specializing in acquisitions work. This is not a rival company acquiring the sensor division for competitive advantage, this is an investment firm acquiring it for maximum profits. This is good news and bad news — on the good side it means the sensor division has potential value. On the bad side it means that rather than just take the knowledge and skill of the employees and intellectual property, the investment company is going to look for a way to immediately (or quickly) increase the value before it turns around and sells it to someone else. This is where it is good for the investment company, but maybe not for anyone else. It means streamlining — that often means eliminating “redundant” staff, cutting costs (very often R&D…it is expensive and while it can have huge upsides, lots of it doesn’t go anywhere), and selling off assets piecemeal.

Meanwhile, Kodak says it wants to focus on “consumer and commercial inkjet printing, packaging printing and workflow software”. Doesn’t sound like a rosy future for Kodak as a photographic company. I certainly agree that the blame should lie on the people who got Kodak to this point, but I think the writing is in the wall for Kodak as a photographic company. I just hope someone with a sincere interest in continuing film photography buys their photo division — ideally Ilford, but I can’t imagine they have the money…

Hasselblad was bought by an investment fund (Ventizz Capital) in June and another investment fund (Blackstone) just bought a 44% stake in Leica. So it’s not uncommon for private equity funds to invest in (premium) digital imaging.

GLOOM and DOOM!

While I’m not sure exactly what will happen to the new entity there is every reason to believe that either this entity or a new one will fill the gap. If capitalism’s “creative destruction” eats the spin-off and a new company takes over production or the new entity thrives, someone will produce these sensors, and eventually someone will make even better sensors. I believe in smart companies that develop out of circumstances such as these.

Would it have been better if Kodak just went under?